Deputy Governor Hiroshi Nakaso and Director Bunya Fujiwara visited Swedish government financial institutions on March 22, 2016. Furthermore, Mr. Nakaso in the evening gave a lecture at the Royal Swedish Academy of Engineering Sciences.

The visits included the Swedish National Debt Office (Riksgälden) where the Japanese guests met with Director General Hans Lindblad and some of his management board members. Mr. Lindblad described the Swedish system and the adaptations lately made to European Eunion law, concerning bank recovery and deposit guarantee scheme directives.

At the Ministry of Finance Mr. Nakaso met with ”state secretary” (statssekreterare) Karolina Ekholm, and for a short time also with Minister of Finance Magdalena Andersson.

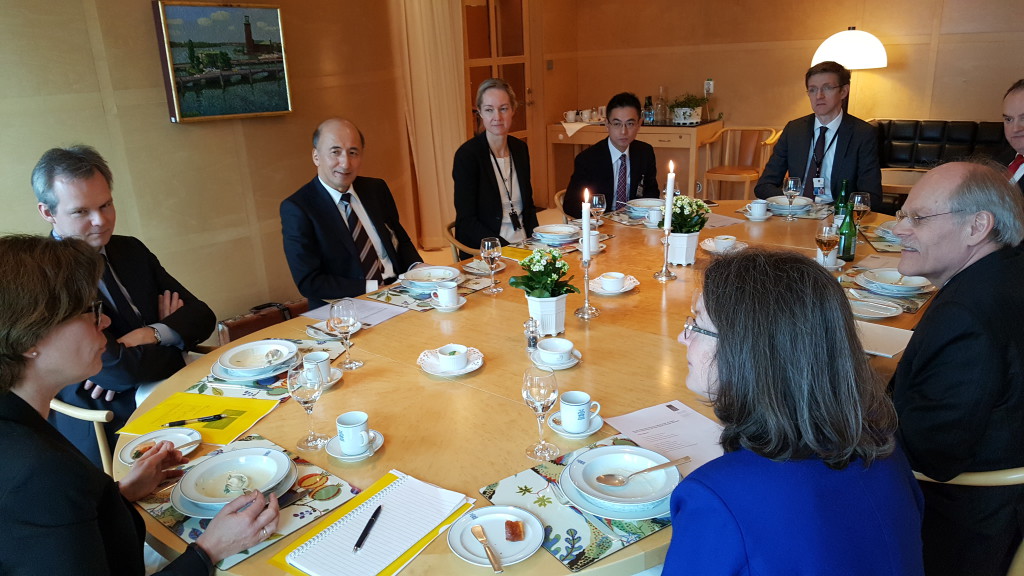

During a two hour lunch at the Bank of Sweden (Riksbanken), hosted by Governor Stefan Ingves, many issues, strategical as well as technical, were discussed. A general conclusion of the meeting was that the two countries as well as their respective national bank have much in common. Only Japan and Sweden in the world have negative interest rates at present.

Deputy Governor Hiroshi Nakaso and director Bunya Fujiwara, both Bank of Japan, during a two hour business lunch at Riksbanken discussed experiences of and challenges for countries with a negative interest rate. Governor Stefan Ingves (right) was accompanied by his deputy governors Peter Jansson, Henry Ohlsson, Cecilia Skingsley and Martin Flodén. Close to the camera are Marianne Nessén (left), head of Monetary Policy Division, and Irma Rosenberg (right), former deputy governor, now accompanying the Japanese guests. (Photo: Edvard Fleetwood, Sweden-Japan Foundation).

In the afternoon at Sweden’s Financial Supervisory Authority (Finansinspektionen) the guests together with Mr. Henrik Braconnier and colleagues discussed the agency’s role as microprudential regulator since the early 1990’s and its responsibility for macroprudence supervision since 2014. Especially mentioned was the limited deposit funding in Sweden compared to the rest of the Euro area, i e the fast rising household debt in Sweden.

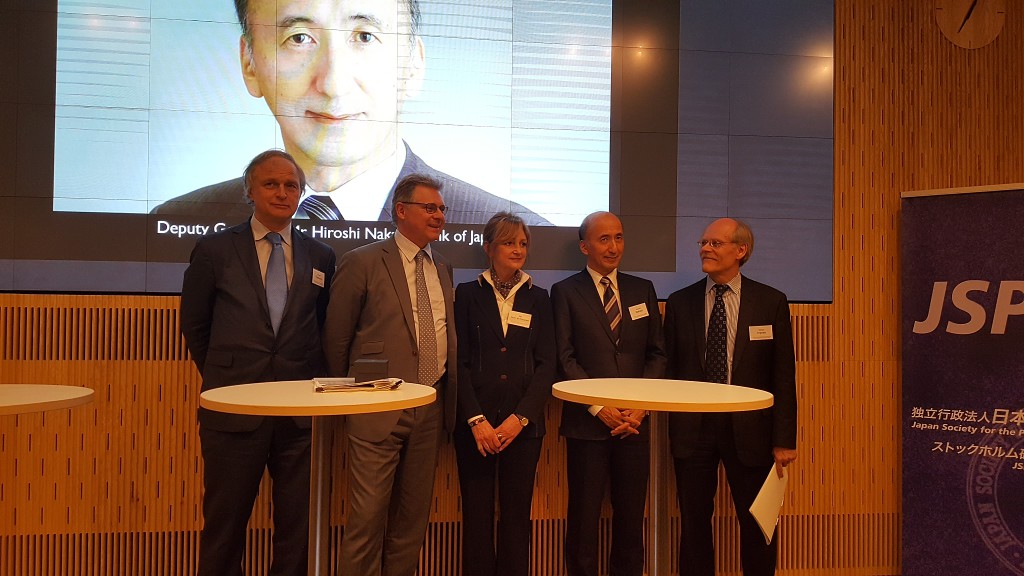

In the evening Mr. Hiroshi Nakaso gave his lecture on the Japanese economy at the IVA. The meeting was arranged by the Academy’s division IX for economics, in cooperation with the Japan Society for the Promotion of Science (JSPS), the Embassy of Japan and the Sweden-Japan Foundation (SJF).

Mr Hiroshi Nakaso, Deputy Governor, Bank of Japan, discussed the Japanese economy with Governor Stefan Ingves (left) and the moderator of the seminar Mr. Klas Eklund (right).

Mr Hiroshi Nakaso, Deputy Governor, Bank of Japan, discussed the Japanese economy with Governor Stefan Ingves (left) and the moderator of the seminar Mr. Klas Eklund (right).

Among issues discussed during the day was noted:

*Japan has a diverse interest rate, of -0,10 %, 0 % and 1 %. The negative interest rate is applied on approximately 4 % of the loans. Mr. Ingves doubted that such a solution could be possible in Sweden, which presently has only one level of its interest.

* The Japanese work force has been deminishing with approximately 0,5 % annually since 2004. To compansate for the decrease of workers, productivity must increase in the service sector, and women need to enter the labor market, according to Mr. Nakaso. Immigration could be possible for certain skills.

*Inflation at a level of 2 % would be desirable both in Sweden and Japan. A problem in Japan is that the public as well as organizations have got used to the present situation and have ”deflation expectations”. While the decreased price of oil has had a positive effect on part of the Japanese economy, it has not helped in reaching inflation targets. Wage increases would stimulate inflation, but unions and companies are reluctant to such measures.

*Japan’s has a major problem with the government debt which presently is 240 % of GDP (Sweden approximatelay 50 % of GDP). If interest rates were to increase the government will have difficulties in paying its interests on loans. Previously the government mainly borrowed from the households. Lately, the business sector has accumulated capital which has partly been lent to the government.

*Sweden’s special challenge is that the low interest rates have driven prices for houses and apartments to very high levels and households to risky levels of debt. While low interest rates are positive for the economy in general, the debt to income ratio maybe has become too high for Swedish households.

Mr Nakaso’s visit to Sweden was a tribute to the late Mr. Robert Stenram, a long time Swedish banker and former vice chair of the Sweden-Japan Foundation. Mr. Edvard Fleetwood, Secretary General of the Sweden-Japan Foundation, made commorative remarks and commanded a moment of silence for Mr. Stenram. The Stenram family was represented by the daughter Anna Iversen and her husband Mr. Iversen.

Mr. Nakaso gave his lecture as a tribute to his old friend the late Mr. Robert Stenram, a long term Swedish banker and vice chair of the Sweden-Japan Foundation. Mr Nakaso greets the daughter of Mr. Stenram, Mrs. Anna Iversen and her husband Mr. Iversen.

The speakers at the seminar. From left to right: Mr. Edvard Fleetwood, Sweden-Japan Foundation, Mr. Klas Eklund, SEB, Dr. Mia Horn af Rantzien, chair of IVA division no IX and president of SNS, Mr. Hiroshi Nakaso, Bank of Japan, and Mr. Stefan Ingves, Riksbanken. (Photo: Mika Nitz Petterson, Sweden-Japan Foundation)

Read more:

Dagens nyheter:http://www.dn.se/ekonomi/minusrantan-det-finns-ingen-undre-grans/

Svenska Dagbladet: http://bors-nliv.svd.se/index.php/news/detail/cfb7fabe-88e5-4682-93ae-38bf91f0c855